I-2124 Will Put Us At The Mercy Of Big Insurance

I-2124 will cause more than 3 million workers in Washington to lose the only affordable, flexible, state guaranteed benefit to help cover the costs associated with long term care.

Neither health insurance nor Medicare pays for long term care - home care aides, medical equipment and home modifications or care in a residential facility when we need help with daily living activities like getting around, dressing, bathing, making meals and managing medication. The only way to pay for the care we need will be to drain our life savings to qualify for Medicaid, or try to buy an expensive private long term care policy.

Buyer beware when I-2124 backers tell you the private marketplace is the solution

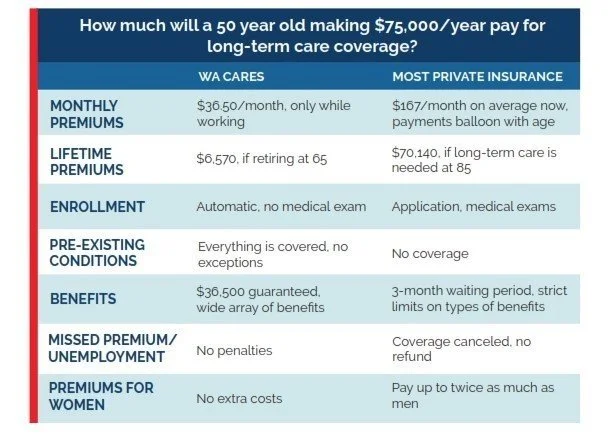

Backers of I-2124 say we should all just buy for-profit long-term care insurance. But the truth is even if you can afford to pay the extremely high premiums, anyone with a pre-existing condition is likely to be denied a long term care policy. Unlike regular health insurance, private long term care insurance companies can and do deny people based on their health and pre-existing conditions.

Long term care insurance companies have poor consumer track records, regularly hiking premiums or reducing benefits, delaying or denying benefit claims. And despite being far more expensive than WA, they require a 90-day waiting period before any claims can be filed, and they put a daily cap on the amount they will reimburse.

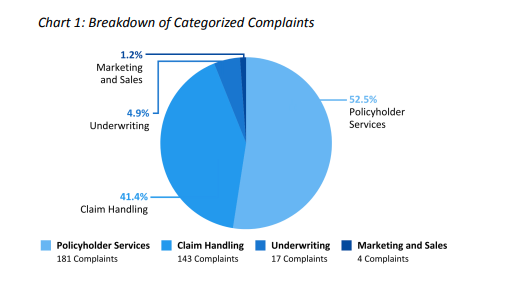

Report: WA consumers find big problems with private long-term care insurance

A new report analyzed hundreds of consumer complaints filed with the WA State Office of the Insurance Commissioner, finding that consumers who buy private long-term care insurance commonly experience:

unaffordable hikes in long-term care insurance premiums,

forced benefit reductions,

difficulty accessing benefits that they have been paying for for years,

policy denials based on preexisting conditions,

claim denials based on complicated and unclear bureaucratic processes, and

barriers to communicating with their insurance companies.

Consumers share their experiences with private long-term care insurance

“When my wife and I bought our policies about twenty years ago, our combined premiums were about $5,000 a year. Every few years they increased substantially. By 2022 they had more than doubled to around $12,000,” said Gifford Jones, a retiree in Seattle. “So far, I have paid $110,619.61 and my wife has paid $52,055.17 for our policies. They have you against a wall, you either have to meet the premium increase or take a reduction in your benefits.”

Philip Christofides, of Walla Walla, shared: “My mother’s big wish was to never be a burden to anybody. She had purchased a long-term care policy twenty five years before she needed it. But we found in the fine print there was a daily maximum which we ran up against quickly, and that the benefit did not increase with inflation. We ended up draining her money and our own to take care of her.”

With Washington’s program, all workers are enrolled and after vesting, can access their benefits anytime they need help due to illness, injury, or aging. We can even use our benefits to pay a family member to care for us, which is not allowed by private insurers.

If I-2124 passes, we lose our benefits and the only winners will be insurance companies.

According to Judith Bendersky who counsels Washingtonians in need of long term care and resources to help cover the costs, often the person needing care may not even remember they have a policy and their family never finds out they had one until it’s too late to use it.